Comparing High Yield Savings Accounts in US vs Singapore

A detailed comparison of high-yield savings accounts available in the US and Singapore to maximize your interest earnings.

A detailed comparison of high-yield savings accounts available in the US and Singapore to maximize your interest earnings.

Comparing High Yield Savings Accounts US vs Singapore

Hey there, savvy savers! Are you looking to make your money work harder for you? In today's financial landscape, simply stashing your cash in a traditional savings account is often a losing game, thanks to inflation. That's where High-Yield Savings Accounts (HYSAs) come into play. These accounts offer significantly higher interest rates than your average savings account, helping your money grow faster. But if you're navigating the financial waters between the US and Singapore, you might be wondering: what are the best options out there? Let's dive deep into a comprehensive comparison of HYSAs in both regions, looking at everything from interest rates and fees to accessibility and specific product recommendations.

Understanding High Yield Savings Accounts What They Are and Why They Matter

Before we get into the nitty-gritty, let's quickly recap what HYSAs are. Essentially, they are savings accounts that offer a higher Annual Percentage Yield (APY) compared to standard savings accounts. This higher APY means your money earns more interest over time. Why do they matter? Because they're a fantastic tool for building an emergency fund, saving for a down payment, or accumulating funds for any short-to-medium term financial goal without the volatility of the stock market. They offer liquidity, meaning you can access your funds relatively easily, unlike some other investment vehicles.

Key Features of High Yield Savings Accounts Interest Rates Fees and Accessibility

When evaluating HYSAs, three main factors stand out: interest rates, fees, and accessibility. The interest rate, or APY, is obviously crucial – the higher, the better. However, always check if the rate is fixed or variable, and how often it might change. Fees can eat into your earnings, so look for accounts with no monthly maintenance fees, no minimum balance fees, and no excessive transaction fees. Accessibility refers to how easily you can deposit and withdraw money. Do they offer online transfers, ATM access, or mobile banking? These are all important considerations.

High Yield Savings Accounts in the United States Top Picks and Features

The US market for HYSAs is quite competitive, with many online-only banks leading the charge. These digital banks often have lower overheads, allowing them to offer more attractive interest rates. Here are some of the top contenders and what makes them stand out:

American Express National Bank High Yield Savings Account A Solid Choice

American Express, known for its credit cards, also offers a very competitive HYSA. As of my last update, their APY is often among the highest in the market, typically ranging from 4.25% to 4.35% APY. There are no monthly maintenance fees and no minimum balance requirements to open or maintain the account. This makes it incredibly accessible for almost anyone. Funds are FDIC-insured up to the legal limit, providing peace of mind. The primary use case for this account is for individuals looking for a straightforward, high-interest savings option with a reputable institution. It's great for emergency funds or short-term savings goals. Transfers are typically done via ACH, which can take a few business days.

Marcus by Goldman Sachs Online Savings Account Simplicity and Strong Rates

Marcus by Goldman Sachs is another strong player in the US HYSA space. They consistently offer competitive APYs, often in the 4.30% to 4.40% range. Similar to American Express, Marcus boasts no monthly fees and no minimum deposit to open an account. They also offer a feature called 'No-Penalty CDs,' which can be an interesting alternative for slightly longer-term savings with a guaranteed rate, but still allowing early withdrawal without penalty. Marcus is known for its user-friendly online interface and excellent customer service. It's ideal for those who appreciate a simple, no-frills approach to high-yield savings with the backing of a major financial institution. Funds are FDIC-insured. Transfers are primarily online.

Synchrony Bank High Yield Savings Account Diverse Features

Synchrony Bank often provides competitive APYs, frequently in the 4.30% to 4.40% range. What sets Synchrony apart is its broader range of features. While it has no monthly fees and no minimum balance, it also offers an ATM card for easier access to funds, which is a nice perk not always found with online-only HYSAs. They also have a rewards program, though the benefits might be modest. Synchrony is a good choice for those who want a high APY but also appreciate the flexibility of an ATM card for occasional cash access. Funds are FDIC-insured. They also offer various CD options. Use cases include emergency funds, travel savings, or even a dedicated fund for a large purchase.

Ally Bank Online Savings Account Popular and Feature Rich

Ally Bank is a pioneer in online banking and remains a very popular choice for HYSAs. Their APY is consistently competitive, often around 4.25% to 4.35%. Ally stands out with its comprehensive suite of online banking tools, including 'buckets' to organize your savings for different goals, and 24/7 customer service. They also offer checking accounts, CDs, and investment products, making it a one-stop shop for many. No monthly fees and no minimum balance are standard. Ally is perfect for those who want a full-service online banking experience with a high-yield savings component. Funds are FDIC-insured. They also offer ATM access through their network and reimbursement for out-of-network ATM fees up to a certain limit.

Discover Bank Online Savings Account Another Strong Contender

Discover Bank, like American Express, is well-known for its credit cards but also offers a solid HYSA. Their APY is typically competitive, often in the 4.25% to 4.35% range. Discover also offers no monthly fees and no minimum balance. They are known for their highly-rated customer service and a robust mobile app. Discover also provides ATM access through their network. This account is suitable for individuals looking for a reliable HYSA from a trusted brand with good customer support and convenient access options. Funds are FDIC-insured. It's a great option for general savings or specific financial goals.

High Yield Savings Accounts in Singapore Exploring the Landscape

The Singaporean banking landscape is a bit different, with a mix of traditional banks and emerging digital players. While the absolute APYs might sometimes appear lower than in the US, it's crucial to consider the overall financial ecosystem, including inflation rates and other investment opportunities. Here are some prominent HYSAs in Singapore:

OCBC 360 Account Maximizing Interest with Multiple Actions

The OCBC 360 Account is a popular choice in Singapore, known for its tiered interest rates that reward customers for performing various banking activities. The base interest rate is typically quite low (e.g., 0.05% p.a.), but you can earn bonus interest by crediting your salary (e.g., 1.20% p.a. for S$1,800-S$3,500), spending on an OCBC credit card (e.g., 0.60% p.a. for S$500+), insuring with OCBC (e.g., 0.60% p.a.), investing with OCBC (e.g., 0.60% p.a.), and growing your balance (e.g., 0.20% p.a. for S$500+ increase). This means you can potentially earn a much higher effective interest rate, sometimes exceeding 4% p.a. on certain portions of your balance, especially for the first S$100,000. The maximum effective interest rate can be quite attractive if you meet all the criteria. This account is best for individuals who actively use OCBC for their primary banking needs, including salary crediting, credit card spending, and potentially insurance or investments. It's a comprehensive solution for maximizing savings within a single bank ecosystem. Funds are insured by SDIC up to S$75,000.

UOB One Account Another Tiered Interest Option

Similar to OCBC 360, the UOB One Account also offers tiered interest rates based on your banking activities. The base interest rate is low (e.g., 0.05% p.a.). You can earn bonus interest by spending a minimum amount on a UOB One Card (e.g., S$500 or S$1,000 per month) and crediting your salary (minimum S$1,600) or making three GIRO debit transactions. The bonus interest rates can push the effective APY significantly higher, potentially reaching up to 5% p.a. for balances up to S$100,000 if all conditions are met. This account is ideal for those who primarily bank with UOB and can consistently meet the spending and salary credit requirements. It's a great way to consolidate your banking and earn higher returns on your savings. Funds are insured by SDIC up to S$75,000.

DBS Multiplier Account Tailored for Diverse Banking Needs

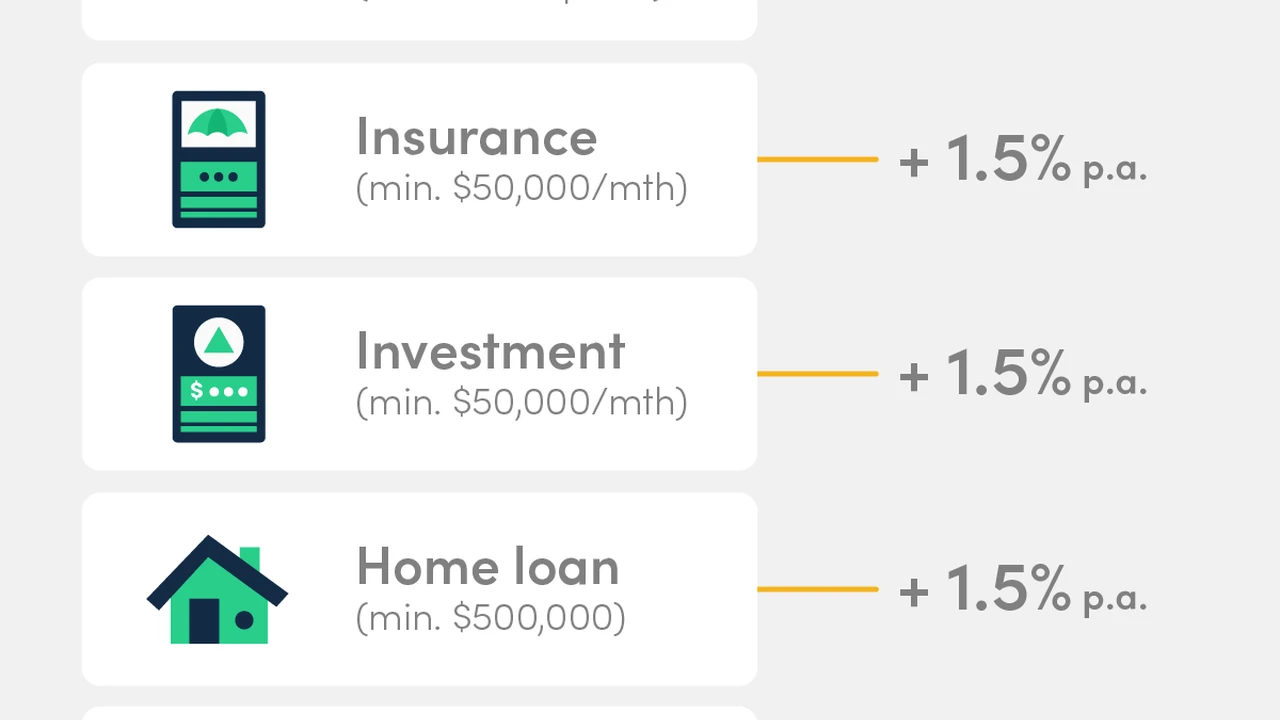

The DBS Multiplier Account is another popular choice in Singapore, offering bonus interest based on the number of categories you transact in with DBS/POSB. These categories include salary credit, credit card spending, home loan installments, insurance, and investments. The base interest rate is low (e.g., 0.05% p.a.). By transacting in multiple categories, you can unlock higher interest rates, potentially reaching up to 4.10% p.a. for balances up to S$100,000. The more categories you engage in, and the higher your total eligible transactions, the higher your interest rate. This account is particularly well-suited for individuals who have a diverse range of financial products with DBS/POSB, making it easy to meet the criteria for higher interest. It's a flexible option for those who want to be rewarded for their overall banking relationship. Funds are insured by SDIC up to S$75,000.

GXS Bank Savings Account A Digital Challenger

GXS Bank, a digital bank backed by Grab and Singtel, is a newer entrant in the Singapore market. They often offer competitive base interest rates without as many hoops to jump through as the traditional banks' tiered accounts. For example, they might offer a flat rate of around 2.68% p.a. on balances up to S$75,000, with no minimum spend or salary credit requirements. This simplicity is a major draw. GXS also offers 'Saving Pockets' to help users organize their savings goals. This account is perfect for those who prefer a straightforward, no-fuss high-yield savings option and are comfortable with digital-only banking. It's great for general savings or specific short-term goals without needing to consolidate all your banking activities. Funds are insured by SDIC up to S$75,000.

MariBank Savings Account Another Digital Option

MariBank, a digital bank by Sea Group (parent company of Shopee and Garena), is another strong contender in Singapore's digital banking space. They often provide competitive interest rates, similar to GXS, without complex conditions. For instance, they might offer a flat rate of around 2.88% p.a. on balances up to S$75,000. MariBank also emphasizes ease of use and integration with the Shopee ecosystem, which can be a bonus for frequent Shopee users. This account is ideal for individuals seeking a simple, high-interest savings account from a digital-first platform, especially if they are already familiar with or use other Sea Group services. Funds are insured by SDIC up to S$75,000.

Comparing the US and Singaporean HYSA Landscape Key Differences and Similarities

Now that we've looked at specific products, let's compare the broader HYSA landscapes in the US and Singapore.

Interest Rate Structures and Earning Potential

In the US, HYSAs typically offer a flat, competitive APY across all balances (or up to a very high limit), with minimal conditions. The rates are generally driven by the federal funds rate and competition among online banks. In Singapore, many of the highest-yielding accounts from traditional banks (OCBC, UOB, DBS) use a tiered bonus interest structure. This means you need to meet certain criteria – like crediting your salary, spending on a credit card, or investing with the bank – to unlock the highest rates. Digital banks like GXS and MariBank offer simpler, flat rates, which might be slightly lower than the maximum achievable rates from traditional banks but come with fewer strings attached. For US residents, maximizing interest is often about finding the highest APY with the fewest fees. For Singapore residents, it's often about optimizing your banking activities to hit those bonus interest tiers.

Accessibility and Banking Ecosystem

US HYSAs are predominantly offered by online-only banks, meaning most interactions are digital. While some offer ATM cards, physical branch access is rare. This makes them highly convenient for digital-savvy users. In Singapore, traditional banks with HYSAs have extensive branch networks and ATMs, offering a blend of digital and physical access. The digital banks, of course, are purely online. The choice here depends on your preference for digital convenience versus the option of in-person banking services.

Regulatory Environment and Deposit Insurance

In the US, HYSAs are typically FDIC-insured up to $250,000 per depositor, per institution, in each ownership category. This provides a high level of security for your deposits. In Singapore, deposits are insured by the Singapore Deposit Insurance Corporation (SDIC) up to S$75,000 per depositor per scheme member. While both offer protection, the coverage limits are different, which might influence how much you choose to keep in a single account, especially for larger sums.

Fees and Minimum Balance Requirements

Most US HYSAs from online banks pride themselves on having no monthly maintenance fees and no minimum balance requirements. This makes them very consumer-friendly. In Singapore, while many accounts also have no monthly fees, some might have minimum average daily balance requirements to avoid fees, or to earn the higher bonus interest. Always read the fine print regarding fees and minimums in both regions.

Choosing the Right High Yield Savings Account for Your Needs Practical Scenarios

So, how do you pick the best HYSA for you? It really depends on your specific situation and where you're primarily banking.

For US Residents Prioritizing Simplicity and High APY

If you're in the US and just want the highest possible APY with minimal fuss, American Express National Bank, Marcus by Goldman Sachs, Ally Bank, Discover Bank, or Synchrony Bank are excellent choices. They offer competitive rates, no fees, and are easy to manage online. They are perfect for building an emergency fund, saving for a car, or a down payment on a house.

For US Residents Valuing Integrated Banking and Features

If you prefer a more integrated online banking experience with features like budgeting tools or ATM access, Ally Bank or Synchrony Bank might be a better fit. Ally's 'buckets' feature is particularly useful for organizing different savings goals.

For Singapore Residents Maximizing Rewards from Existing Banking Habits

If you're in Singapore and already have your salary credited, use a credit card, or have other products with a specific bank, then the tiered accounts like OCBC 360, UOB One, or DBS Multiplier could offer you the highest effective interest rates. You're essentially being rewarded for your existing banking loyalty. These are great for primary savings, emergency funds, and even accumulating funds for larger purchases like a home or car.

For Singapore Residents Seeking Simplicity and Digital Convenience

If you're in Singapore and prefer a straightforward, no-conditions high-yield account from a digital bank, GXS Bank or MariBank are excellent options. They offer competitive flat rates without requiring you to jump through multiple hoops. These are ideal for those who want a simple place to park their savings and earn decent interest without changing their entire banking behavior.

For Expats and Cross Border Savers Navigating Both Markets

For expats or individuals with financial ties to both the US and Singapore, the strategy might involve having HYSAs in both regions. For US-dollar denominated savings, a US-based HYSA will likely offer better rates and easier access. For Singapore-dollar denominated savings, a Singapore-based HYSA is essential. Consider the ease of transferring funds between regions and potential foreign exchange fees when making your decision. It's often best to keep funds in the currency you plan to spend them in to avoid conversion costs.

Maximizing Your Savings Beyond High Yield Accounts Additional Tips

While HYSAs are fantastic, here are a few extra tips to supercharge your savings journey:

Automate Your Savings Set It and Forget It

One of the easiest ways to save more is to automate it. Set up recurring transfers from your checking account to your HYSA immediately after you get paid. Even small, consistent contributions add up significantly over time.

Review Rates Regularly Stay Informed

Interest rates can change. It's a good practice to review the APYs offered by your HYSA and competitors every few months. If a new bank offers a significantly higher rate, don't be afraid to switch. The process of transferring funds between HYSAs is usually quite simple.

Understand the Fine Print Read the Terms and Conditions

Always read the terms and conditions carefully. Look for any hidden fees, minimum balance requirements, or specific conditions to earn the advertised APY. This is especially true for the tiered accounts in Singapore.

Consider Other Investment Vehicles Diversify Your Portfolio

While HYSAs are great for liquid savings and emergency funds, they are not designed for long-term wealth growth that outpaces inflation significantly. For longer-term goals, consider diversifying into investments like stocks, bonds, mutual funds, or ETFs, depending on your risk tolerance and financial goals. HYSAs should be part of a broader financial strategy, not the sole component.

Whether you're in the bustling financial hubs of the US or the dynamic markets of Singapore, high-yield savings accounts offer a valuable way to grow your money safely and efficiently. By understanding the options available and aligning them with your financial habits and goals, you can make an informed decision that puts you on the fast track to financial success. Happy saving!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)