Comparing Secured vs Unsecured Debt and Their Impact

A detailed comparison of secured versus unsecured debt and their respective impacts on your financial health and credit.

Comparing Secured vs Unsecured Debt and Their Impact

Understanding the Fundamentals of Secured and Unsecured Debt for US and Southeast Asian Consumers

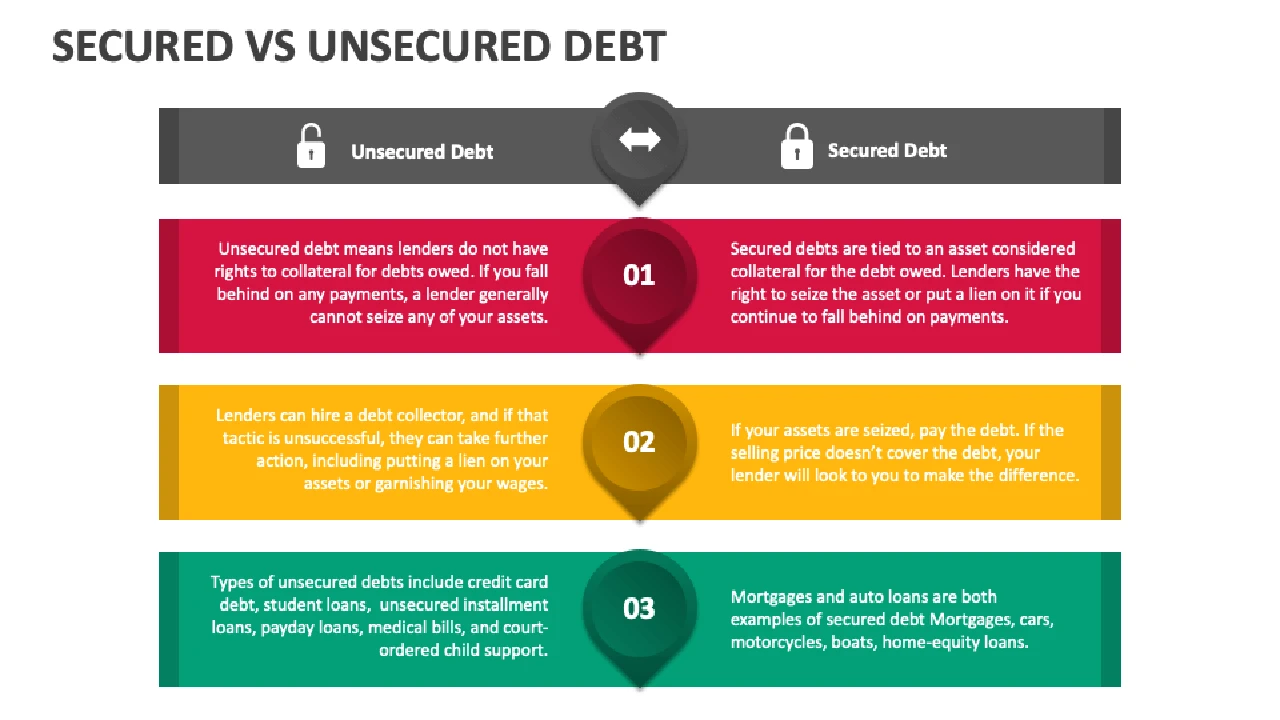

Hey there, money-savvy folks! Let's dive into something super important for your financial well-being, whether you're navigating the bustling markets of the US or the dynamic economies of Southeast Asia: understanding the difference between secured and unsecured debt. It's not just financial jargon; it's a fundamental concept that dictates how much you can borrow, what interest rates you'll pay, and what happens if you can't make your payments. Knowing this distinction is crucial for making smart borrowing decisions and protecting your financial health.

Think of it this way: when you borrow money, the lender is taking a risk. They want to be reasonably sure they'll get their money back. The type of debt – secured or unsecured – essentially tells you how that risk is managed. Let's break it down.

What is Secured Debt Exploring Collateral and Lower Risk for Lenders

Secured debt is pretty straightforward: it's debt that's 'secured' by an asset, also known as collateral. This means you're putting something valuable up as a guarantee that you'll repay the loan. If you fail to make your payments, the lender has the legal right to take possession of that asset to recover their losses. This significantly reduces the risk for the lender, which often translates into better terms for you, the borrower.

Common Examples of Secured Debt in the US and Southeast Asia

- Mortgages: This is probably the most common example. When you buy a house, the house itself serves as collateral. If you stop paying your mortgage, the bank can foreclose on your home. This applies whether you're buying a suburban home in California or a condo in Singapore.

- Auto Loans: Similarly, when you finance a car, the vehicle acts as collateral. Miss too many payments, and the lender can repossess your car. This is standard practice from New York to Jakarta.

- Secured Personal Loans: Some lenders offer personal loans that require collateral, such as a savings account, certificate of deposit (CD), or even a car title. These are often used by individuals with lower credit scores who might not qualify for unsecured loans. For instance, in the Philippines, some lenders might accept a land title as collateral for a personal loan.

- Home Equity Loans and Lines of Credit (HELOCs): These loans use the equity you've built in your home as collateral. They're popular in the US for funding home improvements or consolidating debt. While less common in some parts of Southeast Asia, similar products are emerging in more developed markets like Singapore.

- Pawn Shop Loans: A classic example of secured debt. You bring in an item of value (jewelry, electronics), and the pawn shop lends you money against it. If you don't repay, they keep and sell your item. This is a universal concept, from small towns in the US to bustling markets in Vietnam.

Advantages of Secured Debt for Borrowers in Diverse Markets

- Lower Interest Rates: Because the lender's risk is lower, they can afford to offer you more attractive interest rates. This can save you a significant amount of money over the life of the loan. This is a huge benefit, especially with fluctuating interest rates in both developed and emerging economies.

- Higher Borrowing Limits: With collateral backing the loan, lenders are often willing to lend larger sums of money. This is essential for big purchases like homes or cars.

- Easier to Qualify: If you have a less-than-perfect credit history, secured loans can be an easier way to get approved for financing, as the collateral provides a safety net for the lender. This can be particularly relevant in Southeast Asian markets where formal credit histories might be less established for some individuals.

Disadvantages and Risks of Secured Debt for Financial Health

- Risk of Losing Collateral: This is the big one. If you default on the loan, you could lose the asset you put up as collateral. Losing your home or car can have devastating financial and personal consequences.

- Longer Repayment Terms: While not always a disadvantage, secured loans often come with longer repayment periods, meaning you'll be in debt for a longer time.

- Less Flexibility: The terms of secured loans are often more rigid due to the collateral agreement.

What is Unsecured Debt Examining No Collateral and Higher Risk for Lenders

Unsecured debt, on the other hand, is not backed by any collateral. The lender is essentially taking a bigger gamble on your ability to repay based solely on your creditworthiness, income, and financial history. Because of this higher risk, unsecured loans typically come with higher interest rates and stricter qualification requirements.

Common Examples of Unsecured Debt in the US and Southeast Asia

- Credit Cards: The most ubiquitous form of unsecured debt. Your credit limit is based on your credit score and income, not on an asset you've pledged. This is true whether you're using a Visa in New York or a Mastercard in Bangkok.

- Personal Loans (Unsecured): Many banks and online lenders offer personal loans that don't require collateral. These are often used for debt consolidation, medical expenses, or unexpected costs. These are widely available in both regions, with a growing number of fintech lenders in Southeast Asia offering quick unsecured loans.

- Student Loans: In the US, federal and most private student loans are unsecured. Your future earning potential is the primary factor in repayment. In some Southeast Asian countries, government-backed student loans might also be unsecured, though private options can vary.

- Medical Bills: Unless you've signed a specific agreement to secure them, most medical debts are unsecured.

- Utility Bills: Your monthly electricity, water, and internet bills are typically unsecured debts.

Advantages of Unsecured Debt for Flexibility and Accessibility

- No Collateral Required: The obvious benefit is that you don't have to put any of your assets at risk. This provides peace of mind for many borrowers.

- Faster Approval Process: For some unsecured loans, especially credit cards or smaller personal loans, the approval process can be very quick, sometimes even instant. This is particularly true with the rise of digital banking and fintech in Southeast Asia.

- More Flexible Use of Funds: Unsecured personal loans often allow you to use the funds for almost any purpose, unlike a mortgage or auto loan which is tied to a specific purchase.

Disadvantages and Higher Costs of Unsecured Debt

- Higher Interest Rates: To compensate for the increased risk, lenders charge higher interest rates on unsecured debt. This can make repayment more expensive over time.

- Stricter Qualification Requirements: You generally need a good credit score and a stable income to qualify for favorable terms on unsecured loans.

- Lower Borrowing Limits: Lenders are usually more conservative with the amounts they're willing to lend without collateral.

- Impact on Credit Score: While both types of debt impact your credit, high utilization of unsecured debt (like credit cards) can negatively affect your credit score more quickly.

Impact on Your Credit Score How Secured and Unsecured Debt Differ

Both secured and unsecured debt play a significant role in shaping your credit score, but they do so in slightly different ways. Understanding these nuances is key to building and maintaining a healthy credit profile, whether you're aiming for a prime rate in the US or a favorable loan in Malaysia.

Building Credit with Secured and Unsecured Products

- Secured Loans for Credit Building: For individuals with little to no credit history, a secured credit card or a secured personal loan can be an excellent way to establish credit. Because there's collateral, lenders are more willing to approve these, allowing you to demonstrate responsible repayment behavior. Many banks in both regions offer secured credit cards specifically for this purpose.

- Unsecured Loans and Credit Utilization: Your credit utilization ratio (how much credit you're using compared to your total available credit) is a major factor in your credit score. High utilization on unsecured credit (especially credit cards) can significantly drop your score. Keeping this ratio low (ideally below 30%) is crucial.

- Payment History is King: Regardless of whether the debt is secured or unsecured, your payment history is the most important factor. Making on-time payments consistently for both types of debt will positively impact your score. Late payments, on the other hand, will hurt it severely.

Default and Its Consequences for Both Debt Types

- Secured Debt Default: As mentioned, defaulting on secured debt means losing your collateral. This will also be reported to credit bureaus, severely damaging your credit score for years. Foreclosures and repossessions are major negative marks.

- Unsecured Debt Default: While you won't lose an asset directly, defaulting on unsecured debt will still have a devastating impact on your credit score. The lender can send your account to collections, which will also be reported. They can also pursue legal action to garnish wages or bank accounts, though this process varies significantly between the US and different Southeast Asian countries.

Choosing the Right Debt Type for Your Financial Goals and Situation

So, how do you decide which type of debt is right for you? It's not a one-size-fits-all answer. Your decision should be based on your specific financial situation, credit history, the purpose of the loan, and your risk tolerance.

When Secured Debt Might Be Your Best Option

- Large Purchases: For big-ticket items like a home or a car, secured loans are almost always the way to go. They offer lower interest rates and longer repayment terms, making these purchases more affordable.

- Building Credit: If you're new to credit or trying to rebuild a damaged credit history, a secured credit card or a secured personal loan can be a strategic move.

- Lower Interest Rates are a Priority: If you qualify for both, a secured loan will almost always offer a lower interest rate, saving you money in the long run.

When Unsecured Debt Offers More Flexibility

- Smaller, Shorter-Term Needs: For unexpected expenses, debt consolidation of smaller amounts, or if you don't want to put up collateral, an unsecured personal loan or credit card can be suitable.

- Good Credit History: If you have an excellent credit score, you'll likely qualify for competitive interest rates on unsecured loans, making them a viable option without the risk of losing an asset.

- Emergency Funds: A credit card can serve as a short-term emergency fund, but it's crucial to pay it off quickly to avoid high interest charges.

Product Recommendations and Comparisons for US and Southeast Asian Markets

Let's get into some specific product examples and how they stack up, keeping in mind the diverse financial landscapes of the US and Southeast Asia.

Secured Personal Loans and Credit Cards for Credit Building

If you're looking to build or rebuild credit, secured options are fantastic. Here are a few to consider:

US Market Recommendations

- Discover it Secured Credit Card: This is a highly-rated secured card. You put down a refundable security deposit (e.g., $200-$2,500), which typically becomes your credit limit. It offers cash back rewards (1-2% on various categories) and reports to all three major credit bureaus, making it excellent for credit building. After 7-8 months of responsible use, Discover often reviews your account to transition you to an unsecured card and return your deposit.

- Chime Credit Builder Visa® Credit Card: This is a unique secured card that doesn't require a credit check or a minimum security deposit. Instead, you move money from your Chime checking account into your Credit Builder account, and that money becomes your spending limit. It helps build credit by reporting to all major bureaus. It's great for those who want to avoid a hard credit inquiry.

- Self Lender Secured Personal Loan: This isn't a traditional loan but a credit-builder loan. You borrow a small amount (e.g., $500-$1,000) that's held in a CD. You make monthly payments, and these payments are reported to credit bureaus. Once the loan is paid off, you get the money back. It's a fantastic way to build payment history.

Southeast Asia Market Recommendations

- Maybank Islamic Ikhwan Visa Platinum Card (Malaysia): While not strictly a secured card, Maybank offers various credit cards, and for those with limited credit history, they might offer a secured option where a fixed deposit acts as collateral. It's worth inquiring directly with the bank. Many local banks in Malaysia, like CIMB or Public Bank, also have similar offerings.

- BDO Secured Credit Card (Philippines): BDO, one of the largest banks in the Philippines, offers secured credit cards where a hold-out deposit (usually from a savings account) determines your credit limit. This is a common and effective way for Filipinos to establish credit.

- DBS Secured Credit Card (Singapore): DBS, a leading bank in Singapore, provides secured credit card options. You pledge a fixed deposit as collateral, and your credit limit is a percentage of that deposit. This is a straightforward way to build credit in a highly developed financial market.

- Bank Central Asia (BCA) Secured Credit Card (Indonesia): BCA, a major Indonesian bank, offers secured credit cards where a deposit in a savings account serves as collateral. This is a popular choice for individuals looking to build their credit profile in Indonesia.

Unsecured Personal Loans for Debt Consolidation and Emergencies

When you need funds without collateral and have a decent credit score, unsecured personal loans can be very useful.

US Market Recommendations

- LightStream Personal Loans: Known for competitive rates for borrowers with excellent credit. They offer loans for almost any purpose, from home improvements to debt consolidation, with no fees. Loan amounts typically range from $5,000 to $100,000.

- SoFi Personal Loans: Offers competitive rates, no origination fees, and unemployment protection. They cater to borrowers with good to excellent credit and offer loans up to $100,000. Great for debt consolidation or large expenses.

- Marcus by Goldman Sachs Personal Loans: Offers fixed-rate personal loans with no fees. They are known for their transparent terms and good customer service. Loan amounts typically range from $3,500 to $40,000.

Southeast Asia Market Recommendations

- Standard Chartered CashOne (Singapore): Offers unsecured personal loans with competitive interest rates for eligible customers. Loan amounts can go up to 4x your monthly salary, with flexible repayment terms.

- UOB Personal Loan (Malaysia): UOB provides unsecured personal loans with varying interest rates based on your creditworthiness. They often have promotions and cater to a wide range of income levels.

- CIMB Bank Personal Loan (Thailand): CIMB offers unsecured personal loans in Thailand, often with quick approval processes for eligible applicants. Loan amounts and terms vary.

- Digibank by DBS (Indonesia): DBS's digital bank in Indonesia offers unsecured personal loans that can be applied for entirely online, catering to the growing digital-savvy population.

Mortgages and Auto Loans The Secured Giants

These are almost universally secured, but the terms and providers vary greatly.

US Market Recommendations

- Mortgages: Major banks like Chase, Wells Fargo, Bank of America, and online lenders like Rocket Mortgage (Quicken Loans) are dominant. Rates vary daily, so shopping around is key.

- Auto Loans: Dealership financing, credit unions (often best rates), and banks like Capital One Auto Finance or Chase Auto are popular.

Southeast Asia Market Recommendations

- Mortgages: Local banks are usually the primary providers. For example, in Singapore, DBS, OCBC, and UOB are major players. In Malaysia, Maybank, CIMB, and Public Bank. In Thailand, Bangkok Bank and Krungthai Bank. Always compare rates and terms from multiple banks.

- Auto Loans: Similar to mortgages, local banks and financial institutions are key. Many car dealerships also have partnerships with specific lenders. For instance, in Vietnam, banks like Vietcombank or Techcombank offer auto financing.

Navigating Debt Responsibly Best Practices for Financial Health

Regardless of whether your debt is secured or unsecured, responsible management is paramount. Here are some universal best practices:

- Understand the Terms: Always read the fine print. Know your interest rate, fees, repayment schedule, and what happens if you miss a payment.

- Borrow Only What You Need: Don't take on more debt than you can comfortably repay.

- Create a Budget: A solid budget helps you track your income and expenses, ensuring you have enough money to cover your debt payments.

- Prioritize High-Interest Debt: If you have multiple debts, focus on paying off the ones with the highest interest rates first (the debt avalanche method) to save money.

- Build an Emergency Fund: Having 3-6 months of living expenses saved can prevent you from relying on debt when unexpected costs arise.

- Monitor Your Credit: Regularly check your credit report for errors and to track your progress. In the US, you can get free reports annually from AnnualCreditReport.com. In Southeast Asia, credit bureaus like CTOS in Malaysia or Credit Bureau Singapore offer similar services.

- Seek Professional Help: If you're struggling with debt, don't hesitate to contact a credit counseling agency or financial advisor. They can help you develop a repayment plan.

Ultimately, both secured and unsecured debt have their place in personal finance. The key is to understand their differences, leverage their advantages when appropriate, and manage them responsibly to build a strong and resilient financial future, no matter where you are in the world.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)