How to Get Out of Debt Without Taking on More Debt

A guide on how to strategically get out of debt without resorting to taking on additional loans or credit.

How to Get Out of Debt Without Taking on More Debt

Hey there! Are you feeling the weight of debt pressing down on you? It's a common struggle, and many people find themselves in a cycle where they try to pay off old debt by taking on new debt. This often leads to a never-ending treadmill of payments and stress. But what if I told you there's a way to break free without digging yourself into a deeper hole? That's right, we're talking about getting out of debt strategically, without resorting to additional loans or credit. It's totally doable, and I'm here to walk you through it.

Understanding Your Debt Landscape What You Owe and To Whom

Before you can tackle your debt, you need to know exactly what you're up against. Think of it like mapping out a battlefield before you go into war. You need to identify all your enemies (your debts) and understand their strengths (interest rates) and weaknesses (minimum payments).

List All Your Debts Interest Rates and Minimum Payments

Grab a pen and paper, or open up a spreadsheet. List every single debt you have. This includes credit cards, personal loans, student loans, car loans, medical bills, and even that money you owe your Aunt Sally. For each debt, write down:

- The creditor (who you owe)

- The current balance

- The interest rate (this is super important!)

- The minimum monthly payment

- The due date

Don't shy away from this step. It might feel overwhelming, but seeing everything laid out will give you clarity and empower you to make a plan.

Calculate Your Total Debt Burden and Monthly Commitments

Once you have your list, sum up all the balances to get your total debt. Then, sum up all your minimum monthly payments. This gives you a clear picture of your overall debt burden and how much you're currently committed to paying each month. This number is crucial because it tells you how much wiggle room you might have in your budget.

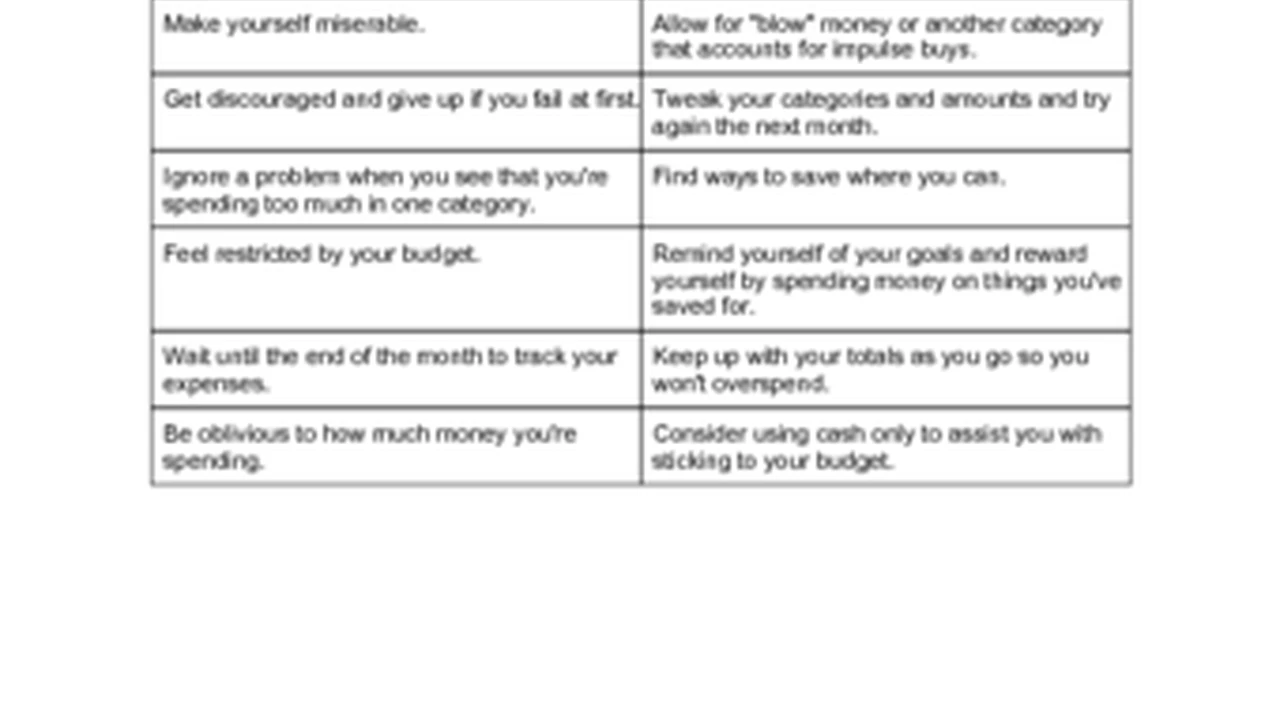

Creating a Realistic Budget Your Debt Free Blueprint

A budget isn't about restricting yourself; it's about giving every dollar a job. When you're trying to get out of debt, your budget becomes your most powerful tool. It's your blueprint for financial freedom.

Track Your Income and Expenses Every Penny Counts

For at least a month, track every single dollar that comes in and every single dollar that goes out. This might sound tedious, but it's eye-opening. You'll discover where your money is actually going, and you might be surprised by how much you spend on things you don't even remember buying. There are tons of apps and tools to help with this:

- Mint: A popular free app that links to your bank accounts and credit cards, categorizing your spending automatically. It's great for seeing where your money goes at a glance.

- You Need A Budget (YNAB): This is a paid app, but many swear by its 'give every dollar a job' philosophy. It's more proactive than reactive, helping you plan your spending before you do it. They offer a free trial, so you can see if it's for you.

- Personal Capital: Excellent for tracking net worth and investments, but also has good budgeting features. It's free and offers a holistic view of your finances.

- Good Old Spreadsheet: If you're a DIY person, a simple Google Sheet or Excel spreadsheet can work wonders. Just create columns for date, description, category, and amount.

Identify Areas to Cut Expenses and Free Up Cash

Once you see your spending habits, it's time to get surgical. Look for areas where you can cut back. This isn't about deprivation forever, but about making temporary sacrifices to achieve a bigger goal. Think about:

- Subscriptions: Do you really need all those streaming services, gym memberships you don't use, or monthly boxes? Cancel or pause the ones you can live without.

- Eating Out/Takeout: This is a huge money drain for many. Try cooking at home more often. Even cutting back by a few meals a week can save a significant amount.

- Entertainment: Look for free or low-cost activities. Instead of going to the movies, have a game night at home.

- Transportation: Can you walk, bike, or use public transport more often? Carpooling is another great option.

- Impulse Buys: Implement a '24-hour rule' – if you want to buy something non-essential, wait 24 hours. Often, the urge passes.

The goal here is to find 'extra' money that you can redirect towards your debt. Every dollar you free up is a dollar that can work for you, not against you.

Choosing Your Debt Repayment Strategy The Smart Way Out

Now that you know what you owe and where you can find extra cash, it's time to pick a battle plan. There are two main strategies that don't involve taking on new debt:

Debt Snowball Method Small Wins Big Motivation

The debt snowball method focuses on psychological wins. Here's how it works:

- List all your debts from smallest balance to largest balance, regardless of interest rate.

- Make minimum payments on all debts except the smallest one.

- Throw all your extra money at the smallest debt until it's paid off.

- Once the smallest debt is gone, take the money you were paying on that debt (minimum payment + extra money) and apply it to the next smallest debt.

- Repeat until all debts are paid.

Why it works: Paying off that first small debt gives you a huge boost of motivation. You see progress quickly, which helps you stay committed. It's like rolling a snowball down a hill – it gets bigger and faster as it goes.

Example:

- Credit Card A: $500 balance, 20% interest, $25 minimum payment

- Personal Loan B: $2,000 balance, 10% interest, $50 minimum payment

- Student Loan C: $10,000 balance, 5% interest, $100 minimum payment

You'd pay the minimums on B and C, and throw all extra money at Credit Card A. Once A is paid, you'd take the $25 (plus any extra money you found) and add it to the $50 minimum for Personal Loan B, paying $75+ extra until B is gone. Then you'd roll that total into Student Loan C.

Debt Avalanche Method Save More on Interest

The debt avalanche method is mathematically more efficient because it saves you the most money on interest. Here's the drill:

- List all your debts from highest interest rate to lowest interest rate, regardless of balance.

- Make minimum payments on all debts except the one with the highest interest rate.

- Throw all your extra money at the debt with the highest interest rate until it's paid off.

- Once that debt is gone, take the money you were paying on it (minimum payment + extra money) and apply it to the debt with the next highest interest rate.

- Repeat until all debts are paid.

Why it works: By tackling the highest interest rate first, you reduce the total amount of interest you pay over the life of your debt. This means more of your money goes towards the principal, and you get out of debt faster in terms of total cost.

Example: Using the same debts as above:

- Credit Card A: $500 balance, 20% interest, $25 minimum payment

- Personal Loan B: $2,000 balance, 10% interest, $50 minimum payment

- Student Loan C: $10,000 balance, 5% interest, $100 minimum payment

You'd still pay minimums on B and C, but you'd throw all extra money at Credit Card A first because it has the highest interest rate (20%). Once A is paid, you'd move to Personal Loan B (10%), and then Student Loan C (5%).

Which Method is Right for You Motivation vs Math

Both methods are effective. The best one for you depends on your personality. If you need quick wins to stay motivated, go with the debt snowball. If you're disciplined and want to save the most money, the debt avalanche is your champion. There's no wrong choice, as long as you stick with it!

Boosting Your Income Without Taking on More Debt

Sometimes, cutting expenses isn't enough, or you've cut everything you possibly can. That's when it's time to look at increasing your income. This doesn't mean taking out a loan; it means finding legitimate ways to earn more money.

Side Hustles and Freelancing Turn Skills into Cash

The gig economy is booming, and there are countless ways to earn extra cash using skills you already have or can quickly learn. The beauty of a side hustle is that all the income can go directly towards your debt repayment.

- Freelance Writing/Editing: If you have a knack for words, platforms like Upwork, Fiverr, or even direct outreach to small businesses can land you gigs.

- Graphic Design: Similar to writing, if you're good with visuals, there's a demand for logos, social media graphics, and website design.

- Web Development/Coding: High-demand skills that can command good rates on freelance platforms.

- Tutoring: Share your knowledge in a subject you excel at, either online or in person. Platforms like Chegg Tutors or TutorMe can connect you with students.

- Delivery Services: Drive for Uber Eats, DoorDash, or Grubhub in your spare time.

- Pet Sitting/Dog Walking: If you love animals, this can be a fun and flexible way to earn money. Check out Rover or Wag.

- Virtual Assistant: Many businesses need help with administrative tasks, social media management, or customer service.

- Online Surveys/Microtasks: While not high-paying, sites like Swagbucks, Amazon Mechanical Turk, or Survey Junkie can earn you a few extra dollars in your downtime.

Product Recommendations for Side Hustles:

- Upwork/Fiverr: These are marketplaces for freelancers. You create a profile, list your services, and bid on projects. They take a commission, but they connect you with clients worldwide.

- Canva: If you're doing graphic design, the free version of Canva is incredibly powerful for creating professional-looking designs quickly. The Pro version (around $12.99/month) unlocks even more features.

- Zoom/Google Meet: Essential for online tutoring or virtual assistant work, both offer free tiers for basic use.

Selling Unused Items Declutter and Earn

Look around your house. Do you have clothes you haven't worn in a year? Electronics gathering dust? Furniture you no longer need? Selling these items is a fantastic way to generate lump sums of cash that can make a significant dent in your debt.

- eBay: Great for electronics, collectibles, and unique items. Be mindful of shipping costs and seller fees.

- Facebook Marketplace: Excellent for local sales of larger items like furniture, appliances, or even clothing bundles. No shipping involved, just local pickup.

- Poshmark/Depop/Vinted: Specifically for clothing, shoes, and accessories. Poshmark takes a 20% commission on sales over $15, and a flat $2.95 for sales under $15.

- Decluttr/Gazelle: For selling old electronics like phones, tablets, and smartwatches. They offer instant quotes and free shipping.

- Consignment Shops: For higher-end clothing or furniture, local consignment shops can be a good option, though they take a cut of the sale.

Think of it as decluttering your life and your debt at the same time. It's a win-win!

Negotiating with Creditors A Direct Approach

Sometimes, you can directly impact your debt by talking to your creditors. This isn't about getting a new loan; it's about making your existing debt more manageable.

Request Lower Interest Rates or Payment Plans

It might sound scary, but creditors often prefer to work with you rather than have you default on your payments. Call them up and explain your situation. Be polite, firm, and prepared.

- Credit Card Companies: Ask if they can lower your interest rate. If you've been a good customer (paying on time, even if it's just the minimum), they might be willing to help. Mention if you're considering transferring your balance (even if you're not actually going to take on new debt, it shows you're exploring options).

- Medical Bill Providers: Many hospitals and clinics have financial assistance programs or are willing to negotiate payment plans or even reduce the total bill, especially if you can pay a portion upfront.

- Student Loan Servicers: Explore income-driven repayment plans if you're struggling with federal student loans. For private loans, you might be able to negotiate a temporary deferment or forbearance, but be aware that interest might still accrue.

The worst they can say is no, but they might say yes, and that could save you a significant amount of money and stress.

Avoid Debt Settlement Companies Unless Absolutely Necessary

Be very wary of debt settlement companies. While they promise to reduce your debt, they often come with high fees, can damage your credit score, and there's no guarantee of success. They typically advise you to stop paying your creditors, which can lead to late fees, collection calls, and lawsuits. This is usually a last resort, and if you're considering it, consult with a non-profit credit counseling agency first.

Building a Financial Buffer Your Safety Net

As you're paying down debt, it's crucial to simultaneously build a small emergency fund. This might seem counterintuitive – shouldn't all extra money go to debt? – but it's a vital step to prevent taking on new debt in the future.

The Mini Emergency Fund Prevent New Debt

Aim for a mini emergency fund of $1,000 to $2,000. This money is specifically for unexpected expenses like a car repair, a medical bill, or a sudden job loss. If you don't have this buffer, these emergencies often lead people right back to their credit cards, undoing all their hard work.

Keep this money in a separate, easily accessible savings account. Don't invest it; you need it liquid. Think of it as insurance against future debt.

Automate Your Savings and Debt Payments Consistency is Key

Once you've set up your budget and chosen your debt repayment strategy, automate everything you can. Set up automatic transfers from your checking account to your emergency fund savings account each payday. Set up automatic payments for your debts, ensuring you always pay at least the minimum on time, and ideally, your extra payment towards your target debt.

Automation takes the willpower out of the equation. You're less likely to forget a payment or spend money that was earmarked for savings or debt repayment.

Maintaining Momentum and Staying Debt Free

Getting out of debt is a marathon, not a sprint. There will be good days and bad days. The key is to stay focused and celebrate your progress.

Celebrate Milestones Stay Motivated

Did you pay off your first credit card? Did you hit your $1,000 emergency fund goal? Celebrate these wins! It doesn't have to be expensive. A nice meal at home, a walk in the park, or a small treat can help keep your spirits high and remind you why you're doing all this hard work.

Review Your Progress Regularly Adjust as Needed

Your financial situation isn't static, so your budget and debt plan shouldn't be either. Review your progress monthly. Are you sticking to your budget? Are you making good progress on your debt? Do you need to adjust your spending or find new ways to earn extra income? Life happens, and flexibility is important.

Build Healthy Financial Habits for the Long Term

Once you're debt-free, the real work of building wealth begins. Continue to budget, save, and invest. Your debt-free journey will have taught you invaluable lessons about financial discipline and resourcefulness. These habits will serve you well for the rest of your life, ensuring you stay out of debt and build a secure financial future.

Getting out of debt without taking on more debt is a powerful and achievable goal. It requires discipline, a clear plan, and a willingness to make temporary sacrifices. But the freedom and peace of mind that come with being debt-free are absolutely worth it. You've got this!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)