The Best Tools for Family Budgeting in 2024

Discover the best tools and apps for effective family budgeting in 2024, suitable for families in the US and Southeast Asia.

The Best Tools for Family Budgeting in 2024

Managing family finances can feel like herding cats, right? Between groceries, school fees, utilities, and the occasional splurge, keeping track of where every dollar goes is a monumental task. But fear not! In 2024, there's a fantastic array of budgeting tools and apps designed specifically to make family budgeting not just manageable, but actually, dare I say, enjoyable? Whether you're in the bustling US or the vibrant markets of Southeast Asia, these tools can help you gain control, save more, and plan for a brighter financial future. Let's dive into the best options out there, comparing their features, use cases, and even their price tags.

Why Family Budgeting Tools Are Essential for Financial Health

Before we get into the nitty-gritty of specific tools, let's quickly touch on why having a dedicated family budgeting system is so crucial. It's not just about cutting costs; it's about understanding your financial landscape, making informed decisions, and working together as a family towards common goals. For families in the US, navigating everything from mortgage payments to college savings can be complex. In Southeast Asia, where financial landscapes can vary wildly between countries like Singapore, Malaysia, and the Philippines, understanding local nuances and optimizing spending is equally vital. A good budgeting tool provides transparency, accountability, and a clear roadmap to financial success.

Key Features to Look for in Family Budgeting Apps and Software

When you're sifting through the myriad of options, what should you prioritize? Here are some key features that make a budgeting tool truly family-friendly:

- Shared Access and Collaboration: This is paramount for families. Everyone who needs to be involved (spouses, older children) should have access to view and, if appropriate, input data.

- Bank Account Integration: Automatic syncing with bank accounts, credit cards, and investment accounts saves a ton of time and reduces manual errors.

- Customizable Categories: Every family's spending is unique. The ability to create and modify spending categories is a must.

- Goal Tracking: Whether it's saving for a down payment, a family vacation, or college tuition, the tool should help you set and track progress towards financial goals.

- Reporting and Visualization: Clear charts and graphs help you understand your spending patterns at a glance.

- Bill Reminders: Never miss a payment again! Automated reminders for upcoming bills are a lifesaver.

- Security: Your financial data is sensitive. Ensure the app uses robust encryption and security protocols.

- Mobile Accessibility: A user-friendly mobile app is essential for on-the-go tracking and quick updates.

- Multi-Currency Support: Especially relevant for families in Southeast Asia or those with international financial dealings.

Top Family Budgeting Tools and Apps for US and Southeast Asia

Alright, let's get to the good stuff! Here are some of the best family budgeting tools available in 2024, with a focus on their suitability for both US and Southeast Asian users.

You Need A Budget YNAB The Rule Based Budgeting Champion

Overview: YNAB is more than just an app; it's a budgeting philosophy. It operates on four simple rules: Give Every Dollar a Job, Embrace Your True Expenses, Roll With the Punches, and Age Your Money. This zero-based budgeting approach means every dollar you have is assigned a purpose, preventing overspending and encouraging intentional saving.

Use Cases: YNAB is fantastic for families who want to be very hands-on and intentional with their money. It's particularly effective for those looking to break the paycheck-to-paycheck cycle, pay down debt aggressively, or save for significant goals. Its focus on future planning makes it ideal for families planning for college, retirement, or large purchases.

Key Features:

- Zero-Based Budgeting: Assigns every dollar to a category.

- Bank Sync: Connects to thousands of banks worldwide, including many in Southeast Asia.

- Goal Tracking: Robust features for setting and tracking financial goals.

- Detailed Reporting: Provides insights into spending and net worth.

- Educational Resources: Offers workshops, guides, and a supportive community.

- Shared Budgeting: Easy to share access with family members.

Pros: Highly effective for changing financial habits, excellent customer support, strong community, available globally. Its methodology is universally applicable, making it great for both US and Southeast Asian users.

Cons: Steeper learning curve than some other apps, subscription fee can be a deterrent for some, especially in regions with lower average incomes.

Pricing: YNAB typically costs around $14.99 per month or $99 per year. They often offer a free trial period.

Comparison: While its price might seem high, many users find the savings it helps them achieve far outweigh the cost. It's less about tracking past spending and more about planning future spending, which is a key differentiator.

Mint The Free and Feature Rich Option

Overview: Mint, by Intuit, is one of the most popular free budgeting apps. It aggregates all your financial accounts in one place, providing a comprehensive overview of your finances. It's great for families who want a quick and easy way to see where their money is going without a significant time investment.

Use Cases: Mint is perfect for families who are just starting their budgeting journey or those who prefer a more passive approach to tracking their spending. It's excellent for monitoring transactions, setting basic budgets, and getting alerts for unusual activity or upcoming bills. Its broad bank integration makes it suitable for US users, and while its Southeast Asian bank support is growing, it might require more manual input for some regional banks.

Key Features:

- Account Aggregation: Links to bank accounts, credit cards, loans, and investments.

- Budgeting Tools: Automatically categorizes transactions and allows for custom budgets.

- Bill Tracking: Alerts for upcoming bills and payment due dates.

- Credit Score Monitoring: Provides free credit score updates.

- Investment Tracking: Monitors your investment portfolio.

- Financial Goal Setting: Helps set and track savings goals.

Pros: Free to use, user-friendly interface, comprehensive financial overview, widely available in the US, good for basic budgeting and tracking.

Cons: Can be ad-heavy, categorization isn't always perfect and requires manual adjustment, less emphasis on proactive budgeting compared to YNAB, limited direct integration with some Southeast Asian banks.

Pricing: Free.

Comparison: Mint is a fantastic entry point for budgeting due to its zero cost and ease of use. However, for families seeking a more disciplined, rule-based approach to budgeting and saving, YNAB might be a better fit. Mint excels at showing you where your money went, while YNAB helps you decide where your money will go.

Personal Capital The Wealth Management Powerhouse

Overview: While not strictly a budgeting app, Personal Capital offers robust financial tracking and planning tools that are invaluable for families with more complex financial situations, especially those focused on long-term wealth building and retirement planning. It provides a holistic view of your net worth, investments, and cash flow.

Use Cases: Ideal for families in the US and potentially high-net-worth individuals in Southeast Asia who have investments, multiple bank accounts, and are looking for a comprehensive wealth management dashboard. It's less about day-to-day expense tracking and more about big-picture financial health, retirement planning, and investment analysis.

Key Features:

- Net Worth Tracker: Aggregates all assets and liabilities.

- Investment Checkup: Analyzes your portfolio for diversification and fees.

- Retirement Planner: Powerful tools to project your retirement readiness.

- Cash Flow Analyzer: Tracks income and expenses.

- Fee Analyzer: Identifies hidden fees in your investment accounts.

- Financial Advisor Access: Offers optional advisory services for a fee.

Pros: Excellent for investment tracking and retirement planning, free for the basic tools, strong security, provides a holistic view of finances. Its investment focus is highly beneficial for long-term family financial planning.

Cons: Budgeting features are less granular than dedicated budgeting apps, primarily focused on US financial institutions, advisory services come with a significant fee.

Pricing: Basic tools are free. Wealth management services (with human advisors) start at 0.89% of assets under management for the first $1 million, decreasing for higher amounts.

Comparison: Personal Capital complements a budgeting app rather than replacing it. Use it to manage your investments and long-term goals, while a tool like Mint or YNAB handles your daily spending. For families with substantial assets, it's an indispensable tool.

PocketGuard The Overspending Prevention Specialist

Overview: PocketGuard focuses on helping you understand how much money you have 'in your pocket' after accounting for bills, savings, and necessities. It's designed to prevent overspending by giving you a clear, real-time picture of your disposable income.

Use Cases: Great for families who struggle with impulse spending or who want a simple, straightforward way to see how much they can safely spend without dipping into savings or going into debt. It's user-friendly and less intimidating than some of the more complex budgeting systems, making it a good choice for busy parents in both the US and Southeast Asia who need quick insights.

Key Features:

- 'IN MY POCKET' Feature: Shows you how much money is truly available to spend.

- Bill Tracking: Monitors recurring bills and subscriptions.

- Debt Payoff Plan: Helps create strategies to reduce debt.

- Savings Goals: Set and track progress towards various savings goals.

- Negotiate Bills: Can help identify opportunities to lower monthly bills.

Pros: Very intuitive and easy to use, excellent for preventing overspending, clear visualization of disposable income, available in both free and paid versions.

Cons: Free version has limited features, less robust reporting than other apps, bank integration might be more US-centric.

Pricing: Free for basic features. PocketGuard Plus costs $7.99 per month or $79.99 per year for advanced features like custom categories, debt payoff plans, and unlimited goals.

Comparison: PocketGuard is simpler than YNAB and more focused on immediate spending control than Mint. If your primary challenge is overspending and you want a clear, actionable number for what you can spend, PocketGuard is a strong contender.

Goodbudget The Digital Envelope System

Overview: Goodbudget is a digital version of the classic envelope budgeting system. Instead of physical envelopes, you allocate funds to digital 'envelopes' for different spending categories. Once an envelope is empty, you stop spending in that category until the next funding period.

Use Cases: This app is ideal for families who prefer a proactive, cash-based budgeting approach but want the convenience of digital tools. It's excellent for teaching financial discipline and ensuring funds are available for specific purposes. Its manual input focus makes it highly adaptable for users in Southeast Asia, where bank integration might be less comprehensive for other apps.

Key Features:

- Envelope Budgeting: Allocate funds to specific spending categories.

- Sync Across Devices: Share and sync budgets with family members.

- Income and Expense Tracking: Manually input transactions.

- Goal Tracking: Set and track savings goals.

- Reports: Basic reports on spending and income.

Pros: Excellent for disciplined budgeting, great for couples and families to share a budget, teaches financial awareness, highly adaptable for regions with limited bank integration.

Cons: Requires manual transaction entry (no bank sync in the free version), can be time-consuming, less automated than other apps.

Pricing: Free for up to 10 regular envelopes and 10 annual envelopes. Goodbudget Plus costs $8 per month or $70 per year for unlimited envelopes, more accounts, and email support.

Comparison: Goodbudget stands out for its envelope system, which is a powerful method for controlling spending. If you're comfortable with manual entry and want a clear, visual way to manage your budget, it's a fantastic choice, especially for families who want to involve children in understanding money allocation.

Fudget The Ultra Simple Budgeting App

Overview: Fudget prides itself on being incredibly simple. It's essentially a digital ledger where you list your income and expenses. There are no fancy graphs, bank integrations, or complex features. It's just a straightforward way to track money in and money out.

Use Cases: Fudget is perfect for families who are overwhelmed by complex budgeting apps and just want the absolute basics. If you prefer a minimalist approach and are happy with manual entry, Fudget can be surprisingly effective. It's particularly useful for tracking a specific project budget, a vacation budget, or for those in Southeast Asia who might not have access to robust bank syncing with other apps.

Key Features:

- Simple Income/Expense Lists: Easy to add and categorize entries.

- Drag and Drop Reordering: Organize your lists easily.

- Calculates Balance: Shows your running total.

- Export to CSV: For further analysis if needed.

Pros: Extremely easy to use, no learning curve, very affordable (one-time purchase for premium), no ads, great for basic tracking.

Cons: No bank integration, no advanced features like goal tracking or reporting, requires full manual entry, not ideal for complex financial situations.

Pricing: Free for basic features. Fudget Pro is a one-time purchase of $4.99, which unlocks unlimited lists, passcode lock, and CSV export.

Comparison: Fudget is the antithesis of a comprehensive financial management suite. It's for those who want a digital pen and paper, nothing more. If you find other apps too overwhelming, Fudget might be your perfect starting point.

Special Considerations for Families in Southeast Asia

While many of these apps are globally available, families in Southeast Asia face unique challenges and opportunities. Here are some specific points to consider:

- Bank Integration: Not all US-centric apps will seamlessly integrate with local banks in countries like Indonesia, Vietnam, or the Philippines. You might need to rely more on manual entry or choose apps that offer better regional support. Apps like YNAB are continuously expanding their global bank connections, but it's always good to check for your specific bank.

- Multi-Currency Support: If your family deals with multiple currencies (e.g., remittances, international travel, or investments), look for apps that handle currency conversion gracefully.

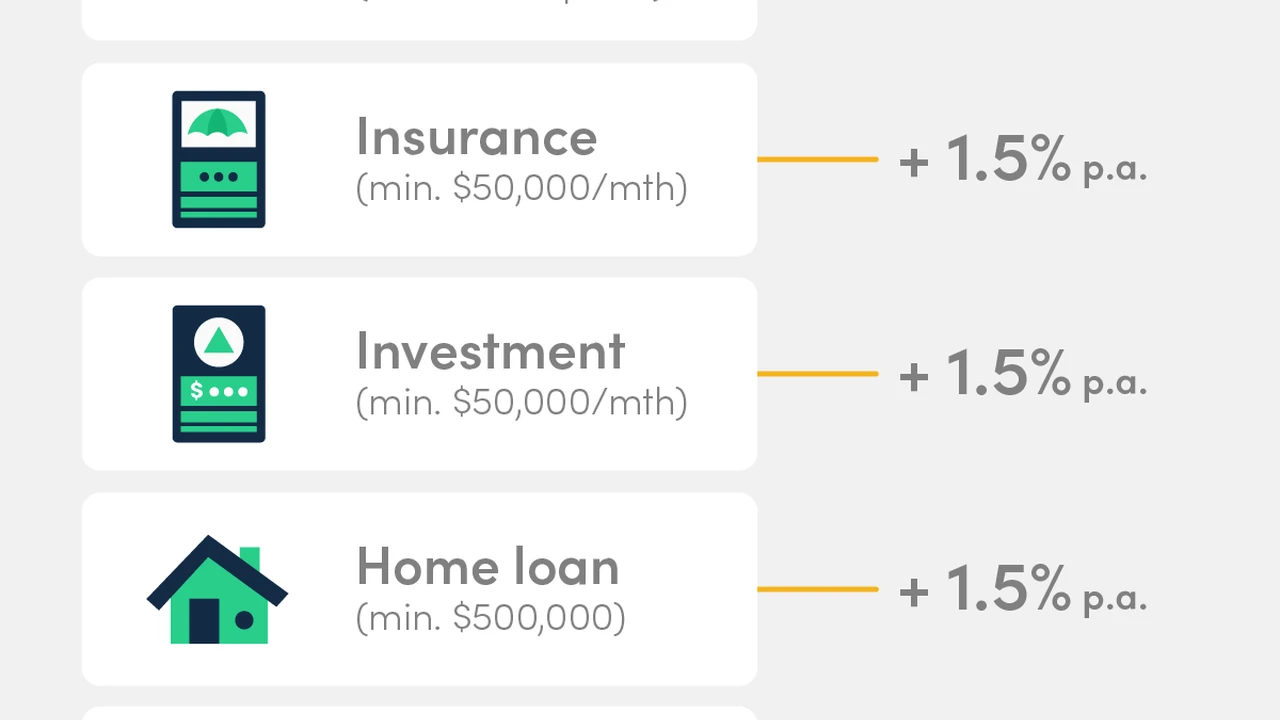

- Local Financial Products: Some apps might not fully recognize or categorize local financial products (e.g., specific types of insurance, local investment vehicles). You might need to create custom categories.

- Security and Data Privacy: Always ensure the app complies with local data privacy regulations and has strong security measures, especially when linking sensitive financial information.

- Internet Connectivity: While generally good, ensure the app works well even with intermittent internet access if you're in areas with less stable connections.

Tips for Successful Family Budgeting with Any Tool

Choosing the right tool is only half the battle. Here are some tips to make your family budgeting efforts a success, regardless of the app you pick:

- Involve the Whole Family: Even young children can learn about money. Involve older children in discussions about family spending and saving goals.

- Be Realistic: Don't create an overly restrictive budget that's impossible to stick to. Start small and adjust as you go.

- Track Everything (Initially): For the first month or two, track every single expense. This gives you a clear picture of where your money is actually going.

- Review Regularly: Set aside time each week or month to review your budget as a family. Discuss what went well and what needs adjustment.

- Automate Savings: Set up automatic transfers from your checking to your savings accounts immediately after payday.

- Be Patient: Changing financial habits takes time. Don't get discouraged by setbacks.

- Celebrate Wins: When you hit a savings goal or pay off a debt, celebrate it as a family! This reinforces positive financial behavior.

The Future of Family Budgeting Technology and AI Integration

The landscape of personal finance technology is constantly evolving. We're seeing more integration of Artificial Intelligence (AI) and machine learning into budgeting apps. This means smarter categorization, more personalized financial advice, and even predictive analytics to help families anticipate future expenses or identify potential savings opportunities. Imagine an app that not only tells you you're over budget on groceries but also suggests cheaper alternatives based on your past purchases and local store flyers. For families in both the US and Southeast Asia, these advancements promise even greater ease and effectiveness in managing their money, making financial planning more intuitive and less of a chore. The goal is to move beyond just tracking to truly intelligent financial guidance that adapts to your family's unique needs and goals.

Ultimately, the best family budgeting tool is the one you'll actually use consistently. Take advantage of free trials, explore different interfaces, and find the app that resonates with your family's financial style and goals. Happy budgeting!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)