The Pros and Cons of Bankruptcy for Debt Relief

Weigh the advantages and disadvantages of filing for bankruptcy as a last resort for debt relief in the US.

The Pros and Cons of Bankruptcy for Debt Relief

Hey there! Let's talk about something pretty serious today: bankruptcy. Nobody wants to think about it, but sometimes, life throws curveballs, and you find yourself in a tough spot financially. When debt becomes overwhelming, and you've exhausted all other options, bankruptcy might pop up as a potential solution. It's a big decision, and it's super important to understand what you're getting into. So, let's break down the good, the bad, and the ugly of filing for bankruptcy in the US.

Understanding Bankruptcy Basics What is Bankruptcy Anyway

First off, what exactly is bankruptcy? In simple terms, it's a legal process designed to help individuals or businesses who can't repay their debts. It offers a fresh start by either discharging (wiping out) certain debts or creating a repayment plan. The US bankruptcy code has different chapters, but for individuals, the two most common types are Chapter 7 and Chapter 13. Think of them as two different paths to debt relief, each with its own rules and outcomes.

Chapter 7 Bankruptcy The Liquidation Option

Chapter 7, often called 'liquidation bankruptcy,' is generally for people with limited income and significant unsecured debt (like credit card debt, medical bills, or personal loans). The main idea here is that a court-appointed trustee sells off some of your non-exempt assets to pay back your creditors. Don't panic, though! Most states have exemptions that protect essential assets like your primary residence, a car, household goods, and retirement accounts. So, you usually don't lose everything. Once the process is complete, most of your unsecured debts are discharged, giving you a clean slate.

Pros of Chapter 7 Bankruptcy Immediate Debt Relief and Fresh Start

- Quick Debt Discharge: This is a big one. Chapter 7 is usually pretty fast, often taking only 3-6 months from filing to discharge. You get rid of most of your unsecured debts relatively quickly.

- Automatic Stay: As soon as you file, an 'automatic stay' goes into effect. This is like a legal force field that stops creditors from trying to collect debts. No more harassing phone calls, no more lawsuits, no more wage garnishments. It's a huge relief from the constant pressure.

- No Repayment Plan: Unlike Chapter 13, you don't have to commit to a multi-year repayment plan. Once your debts are discharged, they're gone.

- Exempt Assets Protection: As mentioned, many of your essential assets are protected by state and federal exemptions. This means you can often keep your home, car, and personal belongings.

Cons of Chapter 7 Bankruptcy Asset Loss and Credit Score Impact

- Potential Asset Loss: While exemptions protect a lot, if you have significant non-exempt assets (like a second home, luxury items, or substantial savings beyond exemption limits), you could lose them. This is why it's called 'liquidation.'

- Credit Score Damage: This is a major drawback. A Chapter 7 bankruptcy stays on your credit report for 10 years. This will significantly impact your ability to get new loans, credit cards, or even rent an apartment for a while.

- Not All Debts Discharged: Important to remember: not all debts can be discharged. Student loans are notoriously difficult to get rid of (though not impossible in very rare cases), as are child support, alimony, recent taxes, and debts incurred through fraud.

- Eligibility Requirements: You have to pass a 'means test' to qualify for Chapter 7. This test looks at your income and expenses to determine if you truly can't afford to pay your debts. If your income is too high, you might be pushed towards Chapter 13.

- Public Record: Bankruptcy is a public record. While most people won't be actively searching for your bankruptcy filing, it's something to be aware of.

Chapter 13 Bankruptcy The Reorganization Option

Chapter 13, often called 'reorganization bankruptcy,' is for individuals with regular income who can afford to repay some of their debts but need a structured plan to do so. Instead of liquidating assets, you propose a repayment plan to the court, typically lasting 3 to 5 years. During this time, you make regular payments to a trustee, who then distributes the money to your creditors. At the end of the plan, any remaining dischargeable debts are wiped out.

Pros of Chapter 13 Bankruptcy Keeping Assets and Stopping Foreclosure

- Keep All Assets: This is a huge advantage. With Chapter 13, you get to keep all of your property, exempt or not. This is often the preferred option for homeowners who want to save their homes from foreclosure.

- Stop Foreclosure and Repossession: Chapter 13 can immediately stop foreclosure proceedings or vehicle repossessions. Your repayment plan can include catching up on missed mortgage or car payments over time.

- Restructure Secured Debts: You can often 'cram down' secured debts (like car loans) to the actual value of the collateral, potentially reducing your payments.

- Protect Co-Signers: If you have co-signers on debts, Chapter 13 can protect them from collection efforts, which Chapter 7 generally doesn't.

- More Debts Dischargeable: While still not everything, Chapter 13 can sometimes discharge a wider range of debts than Chapter 7, including certain types of tax debts or debts from divorce settlements (though not alimony or child support).

Cons of Chapter 13 Bankruptcy Long Term Commitment and Complex Process

- Longer Process: A Chapter 13 plan lasts 3 to 5 years. That's a significant commitment, and you'll be under court supervision for that entire period.

- Repayment Plan: You're required to make regular payments to the trustee, which can be challenging to maintain if your financial situation doesn't stabilize.

- Credit Score Impact: While it stays on your credit report for 7 years (compared to 10 for Chapter 7), it still has a substantial negative impact on your creditworthiness.

- More Complex and Costly: Chapter 13 is generally more complex to file and administer, often leading to higher attorney fees compared to Chapter 7.

- Limited Spending: During your repayment plan, your spending will be scrutinized, and you'll likely have less disposable income.

Considering Alternatives to Bankruptcy Debt Management and Consolidation

Before you even think about bankruptcy, it's crucial to explore other options. Bankruptcy is a last resort, and there are often less drastic ways to tackle debt. Let's look at a couple of common alternatives:

Debt Management Plans DMP Through Credit Counseling

A Debt Management Plan (DMP) is offered by non-profit credit counseling agencies. Here's how it works: you work with a counselor who helps you create a budget and negotiate with your creditors for lower interest rates, waived fees, and a single, manageable monthly payment. The counseling agency then distributes your payment to your creditors. DMPs typically last 3-5 years.

Pros of DMPs Lower Interest Rates and No Credit Score Hit

- Lower Interest Rates: Creditors are often willing to reduce interest rates for people in DMPs, saving you a lot of money.

- Single Monthly Payment: This simplifies your finances immensely.

- No Direct Credit Score Impact: Unlike bankruptcy, a DMP itself doesn't directly harm your credit score. However, if you were already missing payments, your score would have already taken a hit.

- Avoid Bankruptcy: It's a way to get out of debt without the severe consequences of bankruptcy.

Cons of DMPs Not All Creditors Participate and Fees

- Not All Creditors Participate: Some creditors might not agree to the terms of a DMP.

- Fees: Credit counseling agencies often charge a small setup fee and a monthly administrative fee.

- Still a Commitment: You still need to stick to a repayment plan for several years.

Debt Consolidation Loans Combining Debts for Simplicity

A debt consolidation loan is essentially a new loan you take out to pay off multiple smaller debts. The goal is to get a lower interest rate and a single, more manageable monthly payment. This can be a personal loan, a balance transfer credit card, or even a home equity loan.

Pros of Debt Consolidation Simpler Payments and Lower Interest

- Simpler Payments: One payment instead of many.

- Potentially Lower Interest: If you qualify for a good interest rate, you could save a lot on interest charges.

- No Direct Credit Score Impact: Like DMPs, it doesn't directly harm your score, but applying for a new loan will result in a hard inquiry.

Cons of Debt Consolidation Eligibility and Risk of More Debt

- Eligibility: You need a decent credit score to qualify for a low-interest consolidation loan. If your credit is already poor, this might not be an option.

- Risk of More Debt: If you consolidate and then run up your old credit cards again, you'll be in an even worse position.

- Secured Loans Risk: Using a home equity loan for consolidation puts your home at risk if you can't make payments.

Specific Products and Services for Debt Relief Navigating the Market

When you're looking for debt relief, there are a ton of companies and services out there. It's like a jungle, and you need to be careful to pick the right path. Here are some examples of products and services, keeping in mind that I can't endorse specific ones, but I can give you types and what to look for.

Credit Counseling Agencies Non Profit Support

These are often the first stop before considering bankruptcy. They offer DMPs and financial education. Look for agencies accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These accreditations mean they meet certain standards of quality and ethics.

- Example Type: Non-profit credit counseling agencies.

- Usage Scenario: You have significant credit card debt, medical bills, or personal loans, but you have a stable income and want to avoid bankruptcy. You're looking for lower interest rates and a structured repayment plan.

- Comparison: Unlike debt settlement companies (which we'll discuss next), credit counseling aims to repay 100% of your debt, just with better terms. They also provide education.

- Cost: Often a small setup fee (e.g., $0-$50) and a monthly administrative fee (e.g., $25-$75). Some offer free initial consultations.

Debt Settlement Companies Negotiating for Less

Debt settlement companies negotiate with your creditors to pay off your debts for less than the full amount owed. You stop paying your creditors directly and instead put money into a special savings account. Once enough money has accumulated, the settlement company tries to negotiate a lump-sum payment with your creditors. This can sound appealing, but it comes with significant risks.

- Example Type: For-profit debt settlement companies.

- Usage Scenario: You have a large amount of unsecured debt, are struggling to make minimum payments, and are considering bankruptcy but want to try to avoid it. You're okay with a significant hit to your credit score.

- Comparison: Unlike DMPs, debt settlement aims to pay less than the full amount. This means a bigger hit to your credit and potential tax implications on the forgiven debt.

- Cost: Fees are typically a percentage of the enrolled debt (e.g., 15-25%), which can be substantial. These fees are often only paid once a settlement is reached.

- Risks: Your credit score will plummet as you stop paying creditors. You could be sued by creditors. There's no guarantee creditors will settle. Forgiven debt might be taxable income.

Personal Loan Providers for Debt Consolidation Banks and Online Lenders

If you have good credit, a personal loan can be a great way to consolidate high-interest debts. You get a fixed interest rate and a fixed repayment schedule. Many traditional banks and online lenders offer these.

- Example Type: Traditional banks (e.g., Chase, Wells Fargo), credit unions, and online lenders (e.g., SoFi, Marcus by Goldman Sachs, LightStream).

- Usage Scenario: You have multiple high-interest debts (credit cards) and a good to excellent credit score. You want to simplify payments and potentially lower your overall interest rate.

- Comparison: This is a new loan, so you're still responsible for repayment. It's different from bankruptcy, which discharges debt.

- Cost: Interest rates vary widely based on your creditworthiness (e.g., 5% to 36%). Some lenders charge origination fees (e.g., 1-6% of the loan amount).

Balance Transfer Credit Cards 0% APR Offers

Some credit card companies offer 0% APR for an introductory period (e.g., 12-21 months) on balance transfers. This can be a fantastic way to pay down high-interest credit card debt without accruing more interest during that period.

- Example Type: Credit cards from major issuers (e.g., Chase Slate Edge, Citi Simplicity Card, Discover it Balance Transfer).

- Usage Scenario: You have high-interest credit card debt, a good credit score, and you're confident you can pay off the transferred balance before the 0% APR period ends.

- Comparison: This is a short-term solution. If you don't pay it off, the interest rate jumps significantly.

- Cost: Typically, a balance transfer fee (e.g., 3-5% of the transferred amount). No interest during the promotional period, but high interest afterward if not paid off.

Bankruptcy Attorneys Legal Guidance

If bankruptcy is truly your last resort, you'll need a qualified bankruptcy attorney. They guide you through the complex legal process, ensure all paperwork is filed correctly, and represent you in court. This is not a DIY project for most people.

- Example Type: Law firms specializing in bankruptcy law.

- Usage Scenario: You've explored all other options, your debt is overwhelming, and you meet the eligibility requirements for Chapter 7 or Chapter 13.

- Comparison: This is a legal process, not a financial product. An attorney is essential for navigating the courts.

- Cost: Attorney fees for Chapter 7 can range from $1,000 to $3,500, depending on complexity and location. Chapter 13 fees are often higher, sometimes $3,000 to $5,000+, and can sometimes be paid through the repayment plan. Court filing fees are separate (e.g., $338 for Chapter 7, $313 for Chapter 13).

The Emotional and Psychological Impact of Debt and Bankruptcy

Beyond the financial numbers, it's crucial to acknowledge the emotional toll that overwhelming debt takes. The stress, anxiety, and shame can be immense. Bankruptcy, while offering a fresh start, also carries a psychological weight. It can feel like a failure, even though it's often a strategic financial decision. It's okay to feel these things, and seeking support from friends, family, or even a therapist can be really helpful during this time. Remember, your worth isn't tied to your debt, and getting help is a sign of strength, not weakness.

Rebuilding After Bankruptcy Strategies for Financial Recovery

So, you've gone through bankruptcy. What now? The journey isn't over; it's just beginning a new chapter. Rebuilding your financial life and credit score is absolutely possible, but it takes discipline and smart choices.

Secured Credit Cards and Small Loans Starting Fresh

One of the best ways to start rebuilding credit is with a secured credit card. You put down a deposit (which becomes your credit limit), and you use it like a regular credit card. Make small purchases and pay them off in full and on time every month. This shows creditors you can manage credit responsibly. After 6-12 months of good behavior, many secured cards can convert to unsecured cards.

- Example Type: Discover it Secured Credit Card, Capital One Platinum Secured Credit Card.

- Usage Scenario: Immediately after bankruptcy, when your credit score is very low, and you need to establish a positive payment history.

- Cost: Requires a security deposit (e.g., $200-$2,500). May have an annual fee (some don't).

Another option is a credit-builder loan. These are small loans where the money is held in a savings account while you make payments. Once the loan is paid off, you get access to the money, and the payments are reported to credit bureaus.

- Example Type: Self Lender, Credit Strong.

- Usage Scenario: To build payment history and savings simultaneously, especially if you don't have a security deposit for a secured card.

- Cost: Small interest rate on the loan (e.g., 5-15%).

Monitoring Your Credit Report Staying Informed

Regularly check your credit reports from all three major bureaus (Equifax, Experian, and TransUnion). You can get a free report from each once a year at AnnualCreditReport.com. Look for any errors and dispute them immediately. This is crucial for ensuring your credit history is accurate as you rebuild.

Budgeting and Saving for the Future Preventing Recurrence

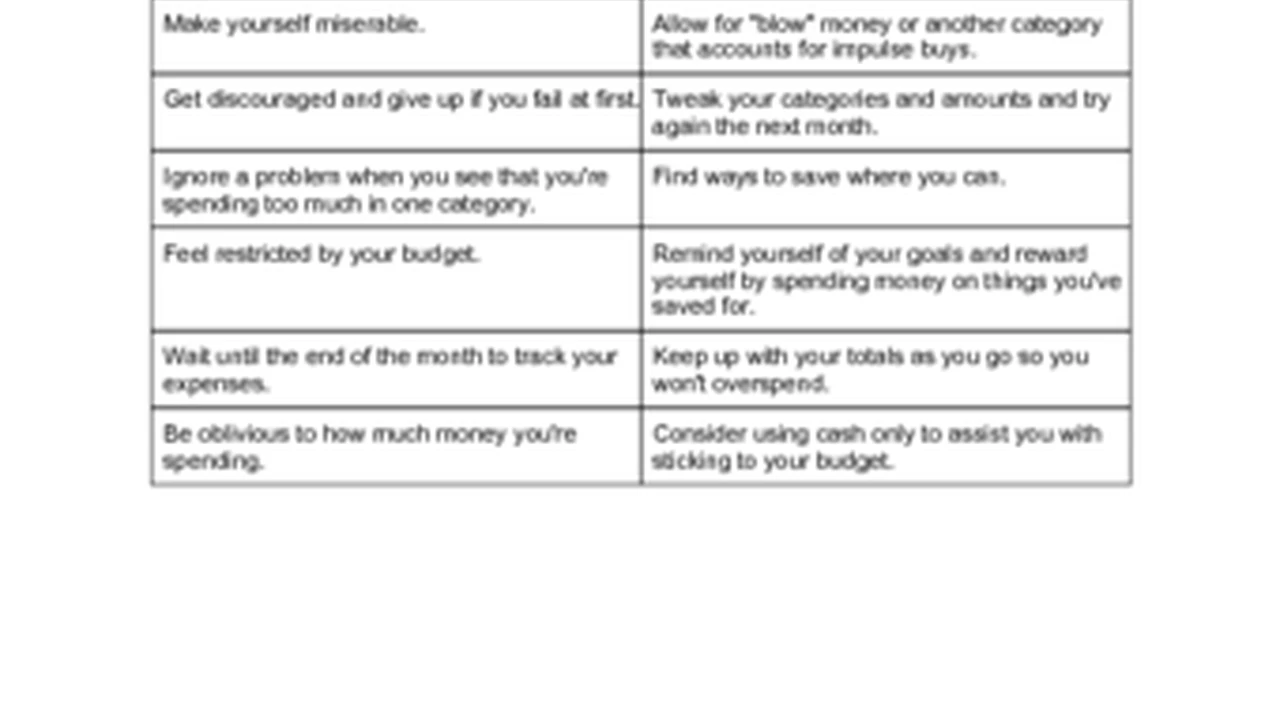

The most important step after bankruptcy is to create and stick to a realistic budget. Understand where every dollar goes. Build an emergency fund so you don't have to rely on credit in a pinch. This financial discipline is key to preventing a return to debt problems.

Financial Education Learning from Experience

Take advantage of financial literacy resources. Many non-profit organizations offer free workshops or online courses on budgeting, saving, and responsible credit use. Learning from your past experiences and gaining new knowledge will empower you to make better financial decisions moving forward.

Ultimately, bankruptcy is a serious step with significant consequences, but for some, it's the necessary path to regain control of their financial lives. It's not a magic bullet, but a tool that, when used wisely and followed by diligent rebuilding efforts, can lead to a healthier financial future. Always consult with a qualified bankruptcy attorney to understand your specific situation and the best course of action for you.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)