Top 5 Debt Management Programs and Their Benefits

Discover the top five debt management programs and their benefits for individuals struggling with overwhelming debt.

Top 5 Debt Management Programs and Their Benefits

Hey there! Are you feeling swamped by debt? You're definitely not alone. Millions of people in the US and Southeast Asia find themselves in a similar boat, staring down a mountain of credit card bills, personal loans, and other financial obligations. It can feel overwhelming, like there's no way out. But guess what? There are solutions, and debt management programs are one of the most effective tools you can use to get back on track. These programs are designed to help you consolidate your debts, lower your interest rates, and create a clear path to becoming debt-free. Let's dive into the top five debt management programs and explore how they can benefit you.

Understanding Debt Management Programs What Are They Really

Before we jump into the specifics, let's clarify what a debt management program (DMP) actually is. A DMP is typically offered by non-profit credit counseling agencies. When you enroll in a DMP, the agency works with your creditors on your behalf to negotiate lower interest rates, waive late fees, and consolidate your multiple monthly payments into one single, more affordable payment. You then make this one payment to the credit counseling agency, and they distribute the funds to your creditors. It's a structured approach to debt repayment that can significantly ease the burden and accelerate your journey to financial freedom.

It's super important to distinguish DMPs from debt settlement or debt consolidation loans. Debt settlement involves negotiating with creditors to pay less than the full amount owed, which can seriously damage your credit score. Debt consolidation loans, on the other hand, are new loans you take out to pay off existing debts, which can be a good option if you qualify for a low interest rate, but it's still a new debt. DMPs focus on paying back 100% of your debt, just under more favorable terms, and generally have a less negative impact on your credit than settlement.

Benefit 1 Lower Interest Rates and Reduced Monthly Payments

One of the biggest headaches with high-interest debt, especially credit card debt, is how quickly the interest charges pile up. It feels like you're just treading water, barely making a dent in the principal. This is where DMPs shine. Credit counseling agencies have established relationships with major creditors and can often negotiate significantly lower interest rates on your behalf. We're talking about dropping from 20-30% APR down to single digits, sometimes even 0% for a period! This reduction in interest means more of your payment goes towards the actual debt, helping you pay it off much faster.

For example, imagine you have $10,000 in credit card debt across three cards, with an average interest rate of 25%. Your minimum payments might be around $300-$400 per month, but a huge chunk of that is just interest. With a DMP, that interest rate could drop to, say, 8-10%. Suddenly, your monthly payment might be reduced to $200-$250, and a much larger portion of that is chipping away at your principal. This makes your debt much more manageable and gives you breathing room in your budget.

Let's look at a hypothetical scenario:

- Original Debt: $10,000 across 3 credit cards

- Average APR: 25%

- Estimated Minimum Payment: $350/month

- Time to Pay Off (minimum payments only): 10+ years, paying thousands in interest

With a DMP:

- Negotiated Average APR: 9%

- New Consolidated Payment: $220/month

- Time to Pay Off: 3-5 years, saving thousands in interest

See the difference? It's substantial!

Benefit 2 Simplified Payments and Streamlined Financial Management

Juggling multiple credit card payments, each with a different due date, minimum payment amount, and online portal, can be a nightmare. It's easy to miss a payment, incur late fees, and further damage your credit score. A debt management program simplifies all of this by consolidating your eligible debts into one single, manageable monthly payment. You make one payment to the credit counseling agency, and they handle the distribution to all your creditors.

This simplification isn't just about convenience; it's about reducing stress and preventing costly mistakes. No more worrying about which bill is due when, or accidentally missing a payment. This streamlined approach frees up mental energy and allows you to focus on rebuilding your financial health rather than constantly tracking due dates.

Think about it: instead of logging into three different credit card websites, remembering three different passwords, and making three separate transactions, you just have one. This is especially helpful for busy individuals or those who travel frequently. It's like having a personal financial assistant for your debt repayment.

Benefit 3 Stopping Collection Calls and Protecting Your Credit

Few things are as stressful as constant phone calls from debt collectors. They can be relentless, intrusive, and frankly, quite intimidating. When you enroll in a debt management program, the credit counseling agency will typically contact your creditors and inform them that you are now under their program. In most cases, this will lead to a significant reduction, if not a complete stop, to collection calls. Creditors prefer to work with reputable agencies to get their money back, even if it's at a lower interest rate, rather than chasing after you directly.

While a DMP itself might show up on your credit report, it's generally viewed more favorably than defaulting on your debts, going through debt settlement, or filing for bankruptcy. Your credit score might take a temporary dip initially, but by consistently making your payments through the DMP, you'll be demonstrating responsible financial behavior, which will help rebuild your credit over time. The goal is to avoid further negative marks like missed payments or accounts going to collections, which DMPs are excellent at preventing.

It's important to note that while collection calls usually stop, you might still receive occasional statements or notices from creditors. However, the aggressive phone calls should cease, providing you with much-needed peace of mind.

Benefit 4 Financial Education and Budgeting Support

A good debt management program isn't just about managing your existing debt; it's also about equipping you with the knowledge and tools to prevent future debt problems. Reputable credit counseling agencies often provide valuable financial education and budgeting support as part of their services. This can include:

- Personalized Budgeting Assistance: Counselors will help you create a realistic budget that accounts for your income, expenses, and debt payments, ensuring you have enough money to cover everything.

- Spending Habit Analysis: They can help you identify areas where you might be overspending and suggest ways to cut back without feeling deprived.

- Financial Literacy Workshops: Many agencies offer workshops or resources on topics like saving, investing, understanding credit, and avoiding financial pitfalls.

- Goal Setting: They'll help you set achievable financial goals beyond just debt repayment, such as building an emergency fund or saving for a down payment.

This educational component is crucial because it addresses the root causes of debt. It empowers you to make smarter financial decisions in the long run, fostering sustainable financial health. It's not just a quick fix; it's a long-term solution.

Benefit 5 A Clear Path to Debt Freedom and Peace of Mind

Perhaps the most significant benefit of a debt management program is the clear, structured path it provides to becoming debt-free. When you're drowning in debt, it's easy to feel hopeless and unsure of how you'll ever get out. A DMP lays out a specific timeline, usually 3-5 years, for when you can expect to be completely free of your unsecured debts. This clarity and predictability can be incredibly motivating and provide immense peace of mind.

Knowing exactly how much you need to pay each month and seeing the finish line in sight can transform your financial outlook. It replaces anxiety with hope and empowers you to take control of your financial future. Imagine the feeling of making that final payment and knowing you're finally debt-free! That's the ultimate goal a DMP helps you achieve.

Top 5 Debt Management Programs and Providers A Closer Look

Now that we've covered the benefits, let's look at some of the top debt management program providers. It's important to remember that these are typically non-profit credit counseling agencies. While I can't endorse specific companies, I can highlight types of reputable organizations and what to look for. Always do your own research and check their credentials with organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

1. National Foundation for Credit Counseling NFCC Member Agencies

The NFCC is a leading non-profit financial counseling organization in the US. They don't offer DMPs directly, but they certify and support a network of member agencies across the country. These agencies adhere to strict standards of quality and ethics. When you choose an NFCC member agency, you can be confident you're working with a reputable organization.

- Key Features: Comprehensive credit counseling, personalized DMPs, financial education, and often housing counseling.

- Target Audience: Individuals and families struggling with various types of unsecured debt.

- How it Works: You'll have an initial consultation with a certified credit counselor who will review your financial situation, help you create a budget, and determine if a DMP is the right fit. If so, they'll negotiate with your creditors.

- Typical Fees: Most NFCC agencies charge a small setup fee (e.g., $0-$75) and a monthly administrative fee (e.g., $25-$50). These fees are usually waived or reduced for those with very low incomes.

- Example Agencies (check for local availability): GreenPath Financial Wellness, Money Management International (MMI), Consumer Credit Counseling Service (CCCS) agencies.

- Use Case: Someone with multiple high-interest credit cards, feeling overwhelmed by payments, and needing structured support and education.

2. Financial Counseling Association of America FCAA Member Agencies

Similar to the NFCC, the FCAA is another respected association that accredits non-profit credit counseling agencies. Their member agencies also provide DMPs and a range of financial education services. Looking for agencies affiliated with either the NFCC or FCAA is a great starting point for finding a trustworthy provider.

- Key Features: Similar to NFCC agencies, focusing on ethical practices, client education, and effective debt resolution.

- Target Audience: Broad appeal for anyone seeking professional, non-profit debt assistance.

- How it Works: The process is generally the same: initial consultation, budget analysis, debt negotiation, and consolidated payments.

- Typical Fees: Comparable to NFCC agencies, with reasonable setup and monthly administrative fees.

- Example Agencies (check for local availability): Many local and regional credit counseling services are FCAA members.

- Use Case: An individual who prefers to work with a smaller, potentially more localized non-profit agency that still adheres to high industry standards.

3. Reputable Online Credit Counseling Services

In today's digital age, many reputable credit counseling agencies offer their services entirely online or over the phone, making them accessible to a wider audience, including those in Southeast Asia who might be dealing with US-based debt or looking for general financial guidance. These services often have robust online portals for managing your account and making payments.

- Key Features: Convenience, accessibility from anywhere, often extensive online resources and tools.

- Target Audience: Individuals who prefer digital interaction, expats, or those in remote areas.

- How it Works: Initial consultation via phone or video call, online document submission, and digital payment processing.

- Typical Fees: Similar fee structures to traditional agencies, with transparency being key.

- Example Agencies: Many of the larger NFCC/FCAA agencies also have strong online presences. Look for those with good online reviews and clear fee disclosures.

- Use Case: An expat in Singapore with US credit card debt, seeking a flexible and accessible debt management solution.

4. Local Community Credit Counseling Centers

Many communities, especially in the US, have local non-profit credit counseling centers. These centers often have a deep understanding of local resources and can provide in-person support, which some people prefer. They are typically funded by grants and community support, allowing them to offer services at low or no cost to eligible individuals.

- Key Features: Personalized in-person support, local resource knowledge, potential for lower fees or free services.

- Target Audience: Individuals who prefer face-to-face interaction, those with very limited income, or those seeking local community support.

- How it Works: Schedule an in-person appointment, bring your financial documents, and work directly with a counselor.

- Typical Fees: Often very low or free, depending on funding and your income level.

- Example Agencies: Search for 'credit counseling near me' or check with local community centers and financial literacy initiatives.

- Use Case: Someone in a specific US city who wants direct, in-person guidance and potentially free services due to financial hardship.

5. Employer-Sponsored Financial Wellness Programs

Some employers, particularly larger corporations, offer financial wellness programs as part of their employee benefits package. These programs often include access to credit counseling services, sometimes at no cost to the employee. If your employer offers such a benefit, it's an excellent, often overlooked, resource for debt management.

- Key Features: Free or heavily subsidized services, convenient access through your workplace, often integrated with other financial benefits.

- Target Audience: Employees of companies that offer these benefits.

- How it Works: Check with your HR department or benefits administrator to see if credit counseling or debt management services are included.

- Typical Fees: Often free for employees.

- Example Providers: Companies like EAP (Employee Assistance Programs) providers often partner with credit counseling agencies.

- Use Case: An employee whose company offers financial wellness benefits, looking for a cost-effective way to manage debt.

What to Look For in a Debt Management Program Provider Key Considerations

Choosing the right debt management program is a big decision. Here are some crucial factors to consider when evaluating providers:

Accreditation and Non-Profit Status Ensuring Trustworthiness

Always, always, always choose a non-profit credit counseling agency that is accredited by a reputable organization like the NFCC or FCAA. This ensures they adhere to ethical standards, provide quality services, and are not trying to make a quick buck off your financial distress. For-profit debt relief companies often push debt settlement, which can have severe negative consequences for your credit.

Transparent Fees Understanding the Costs

Reputable agencies will be completely transparent about their fees. They should clearly outline any setup fees and monthly administrative fees upfront. Be wary of any agency that charges exorbitant fees or asks for large upfront payments before any services are rendered. As mentioned, fees are often low and sometimes waived for those in extreme hardship.

Certified Counselors Expertise Matters

Ensure that the counselors you work with are certified. This means they have undergone specific training and passed exams to demonstrate their expertise in consumer credit, money management, and debt repayment. A certified counselor can provide sound, personalized advice.

Comprehensive Services Beyond Just Debt Management

A good agency will offer more than just a DMP. Look for those that provide comprehensive financial education, budgeting assistance, and resources to help you build long-term financial health. The goal isn't just to get out of debt, but to stay out of debt.

Good Reputation and Reviews What Others Say

Check online reviews and ratings from independent sources like the Better Business Bureau (BBB) or consumer advocacy websites. While individual experiences can vary, a pattern of positive reviews and a high rating indicate a reliable provider. Be cautious of agencies with numerous complaints or unresolved issues.

Availability and Accessibility Meeting Your Needs

Consider whether the agency's services are accessible to you. Do they offer phone consultations, online portals, or in-person meetings if you prefer? For those in Southeast Asia, ensure they can effectively communicate and work with your specific situation, especially if dealing with US-based creditors.

Potential Downsides and What to Watch Out For

While DMPs offer significant benefits, it's important to be aware of potential downsides:

- Credit Score Impact: Your credit score might take a temporary dip when you enroll in a DMP, as creditors might report your accounts as 'managed' or 'closed.' However, this is generally less damaging than bankruptcy or debt settlement, and consistent payments will help rebuild your score.

- Credit Card Usage: You'll typically be required to close or stop using the credit cards included in the DMP. This is crucial to prevent accumulating new debt while paying off old debt.

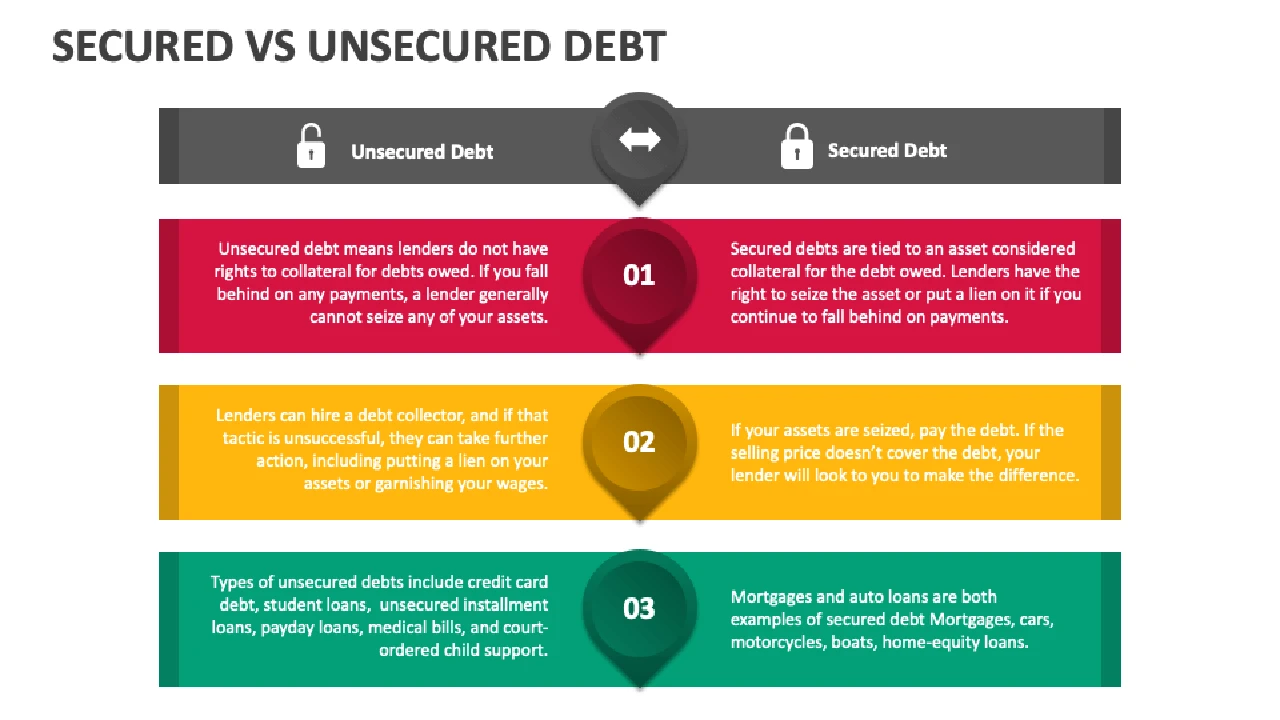

- Not All Debts Included: DMPs usually only cover unsecured debts like credit cards, personal loans, and medical bills. Secured debts (like mortgages or car loans) and student loans are generally not included.

- Commitment Required: A DMP requires discipline and commitment to make consistent payments for several years. If you miss payments, you could be dropped from the program.

- Fees: While generally low, the administrative fees are an additional cost to consider.

Is a Debt Management Program Right for You A Self-Assessment

So, how do you know if a DMP is the right solution for your situation? Consider these questions:

- Are you struggling to make minimum payments on your unsecured debts?

- Are your interest rates so high that you feel like you're not making progress?

- Do you have multiple credit cards or personal loans that are hard to manage?

- Are you receiving collection calls?

- Are you committed to stopping the use of credit cards and sticking to a budget?

- Do you want to pay back 100% of your debt, but need better terms?

- Do you need financial education and budgeting support?

If you answered yes to several of these questions, then exploring a debt management program with a reputable credit counseling agency is definitely a smart move. It could be the lifeline you need to get your finances back on track and achieve lasting debt freedom.

Remember, taking the first step is often the hardest, but it's also the most important. Don't let debt control your life. Seek out professional help, understand your options, and empower yourself to build a brighter financial future.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)